Posted on March 4, 2025 by Erik in Buyer, Home Sellers, Real Estate Agent, Sell My Home Jacksonville, Sell Your House Jacksonville

First Look: State of the Jacksonville Market in 2025

- The number of sold listings in February 2025 was down 24.8% year over year from 2024

- The number of active listings in February 2025 was up 29.7% year over year, reflecting the largest active inventory in over a decade

- The average number of days on the market rose by 2.7% year over year to 77 in February 2025. However, it’s important to note that this reflects a decrease from 85 days in January 2025.

- The average sales price for a listed home rose 1.74% year over year in February 2025.

- The number of pending listings dropped steeply, falling 39.8% year over year in February 2025 from early reporting

February is in the books and winter is almost behind us. With just a few weeks to go until the spring sales season starts to fully kick off, It’s time to take a first look at the numbers for 2025 – and well…things could be better for us here in Jacksonville.

Welcome to the Buyer’s Market

A buyer’s market occurs when the supply of available homes in an area exceeds the demand. Why does it matter? Because in a buyer’s market, the competition is low enough that buyers start to get the upper hand in negotiations. As a seller, you may see little or no activity on your listing, and the activity you do get may be competing with dozens of other homes for sale. It’s a recipe for price cuts and seller concessions, which can ultimately bring down the value of homes in an area – given enough time.

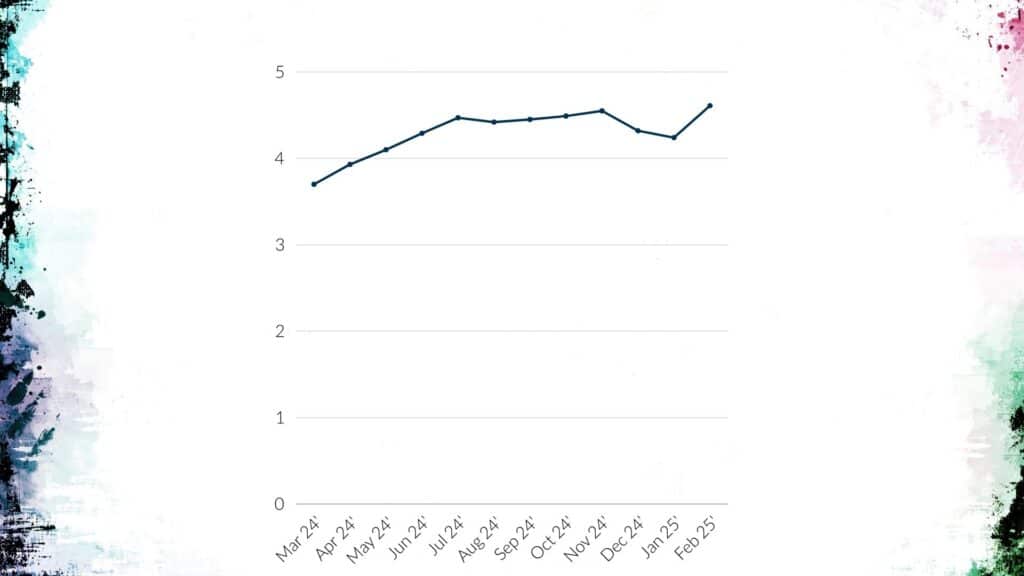

As of 2025, Jacksonville is a buyer’s market. But just barely. There’s currently more than 4.6 months of active residential inventory on the NEFMLS. Meaning that at the current rate of sales, if no new listings were added, it would take just over a third of a year for everything to sell. But the reality is that new listings are being added daily, only serving to drive that number up. For perspective, there were 3374 new residential listings added to the NEFMLS, and only 1579 closed sales in February. As time passes, that gulf will continue to grow unless we see a major market shift.

A chart showing the months supply of residential inventory in Jacksonville Florida

Expect the trend to continue into early spring unless there’s some give in either rates or home prices.

How higher interest rates affect our housing market

Back in 2022 as the average 30 year fixed soared to levels we hadn’t seen in a decade (the last time the average 30 year fixed was above 7% was April 2002) there was a ton of speculation of where things would begin to settle. Unfortunately that’s been a moving target.

Most of the sentiment was that, by the end of 2023, the worst of it was behind us, with rates hitting a high of 7.79% in October. Well respected voices such as Lawrence Yun, who serves as the Chief Economist for the National Association of Realtors®️ made predictions of rates returning to the 5’s by the end of 2024.

As inflation report after inflation report outlined what could only be described as a sticky economy, those expectations were revised to the low 6s, then the mid 6s. And for a while things appeared to be normalizing as rates hit a 2024 low of 6.09% in September. However, negative sentiment and fear around the US economy has dampened expectations further, and rates have again risen to the high 6’s hovering around 6.75% as of the March 2025 writing of this article.

The problem is that mortgage rates dictate a lot about the real estate market. It’s estimated that 70-80% of all home sales are financed. For every 10 homes that sell, 8 will probably need a mortgage. And the difference of just a percent can mean a huge difference in costs. For example, using the average sales price in Jacksonville of $450,000 in February, a buyer will pay more than $100,000 more for the same home at a 7% mortgage rate over a 6% mortgage rate during the lifetime of the loan. Hundreds more each month on the mortgage. That in turn prices buyer’s out, contracting an already tight pool at a time when inventory is soaring.

The good news

I’d describe the tone of our market as flat, bordering on down, but that’s not to say it’s all doom and gloom. There have been some positive markers that hint at resilience if not outright growth.

One such figure is the average number of cumulative days on the market, commonly known as the CDOM. This number tracks how long it takes from initial listing until the day the contract actually closes and everyone gets paid. Winter is historically a slow time for sales, but the CDOM is fairly stable compared to last year at 77, less than a 3% difference. Additionally, the CDOM fell from 84.8 to 77 in the period from January 2025 to February 2025, meaning homes are moving quicker as the year progresses.

The average sale price is also still growing, which is good news for homeowners waiting on the sidelines. In February 2025 the average residential sale price on the NEFMLS was $450,783, a 1.74% increase from $443,085 in February 2024.

Then there’s the Sold to List Ratio, which looks at the average percentage of asking price sellers get on their listings. In January 2025 the ratio dropped significantly, falling to 92.7%, the lowest by a decade. But as of February 2025, the ratio has returned to 94.3%, in line with most of 2024, including much of the summer.

A look at Jacksonville

Markets don’t exist in a vacuum, and as the old adage says: “location, location, location.” When I look at Jacksonville, it’s hard to see anything but potential. I’ve lived here for more than 25 years. In that time I’ve seen a monumental change in not only the city itself, but the energy behind Jacksonville’s growth. As a result, despite the numbers I’m still bullish on the Bold City.

Nothing puts a city on the map like an NFL franchise. And ours (despite last year’s abysmal record) has one heck of a following. The Stadium, currently called Everbank, has long been a focal point of the downtown area, sharing space with Daily’s Place, an outdoor amphitheater, Vystar Memorial Arena where our local hockey team the Iceman play, and Vystar Ballpark, home of the beloved Jumbo Shrimp, which together up our sports district. This year, it’s getting a major makeover.

In June 2024 the team through owner Shad Khan, reached an agreement with the City of Jacksonville to build the Stadium of the Future, a strikingly designed complex of river walks, storefronts, and of course a 63,000 seat NFL stadium that will likely be the envy of every team in the league. This 1.4 billion dollar project has already broken ground and is expected to be completed in 2028.

If 1.4 billion in city infrastructure development wasn’t enough, there are also plans to develop more of Jacksonville’s downtown riverfront, including a 4 seasons hotel with more than 170 luxury rooms on the St. Johns River, Riverfront Plaza with greenspaces are art installations, One Riverside, a major complex which will be home to a new Whole Foods, and of course Gateway Jax, a 5000+ unit mixed development. All on top of recent expansions to bike paths like the Emerald Trail, and outdoor park spaces around the city.

Then, there are the natural resources. Jacksonville has not one, but two major water features. First is the St. Johns River, which iconically cuts through the center of downtown. This river is one of the largest in the world, and our city sits just on the mouth where it joins the Atlantic Ocean. As a result, there are hundreds of miles of riverfront property with docks, boats, and views that can rival the most expensive neighborhoods in South Florida. Second is the Atlantic Ocean itself. Our city is home to miles upon miles of pristine beaches with popular parks, bars, restaurants and hotels. Hard to find anything like-kind on this coast.

Takeaways and What to do as a seller

If you are on the fence about selling your home in Jacksonville, you’ve got some hard decisions ahead. There’s no sugar coating it. Competition amongst listings is high, and sales are slow, so finding ways to make your listing stand out are critical. That means repaired, updated, staged, and professionally photographed homes, ideally vacant and easy to show are your best bet, and anything else is looking at an uphill battle. But waiting for better conditions may not be your friend either.

There’s nothing right now that would indicate interest rates dropping back into the 5’s anytime soon, so I wouldn’t hold your breath that buyers are suddenly going to flock to the market. It’s possible that economic conditions may change, and there’s a lot of uncertainty right now with tariffs and rising inflation, but it won’t happen overnight. Waiting may only lead to more competition, but it could also lead to a higher sales price if values continue to appreciate.

Regardless, Jacksonville is still a reasonably priced market for everything it has to offer, and despite recent concerns over Jacksonvillians debt, there’s nothing to indicate that it won’t continue to grow.

Data Sources:

NEFMLS Residential Market Report February 2025

The views and opinions expressed in this article are those of the author and may not align or reflect those of Duval Home Buyers LLC and/or it’s management or agents. This article is for entertainment purposes only, and should not be relied upon for real estate advice. Always consult a licensed real estate agent or real estate attorney prior to making any real estate decisions.